Current Conditions of the Dow Industrials: A Comprehensive Analysis

The Dow Jones Industrial Average (DJIA) is a critical barometer of U.S. economic health. It measures the performance of 30 large companies across various industries. In 2024, the Dow Industrials are in a volatile state, reflecting the complex conditions of the broader economy.

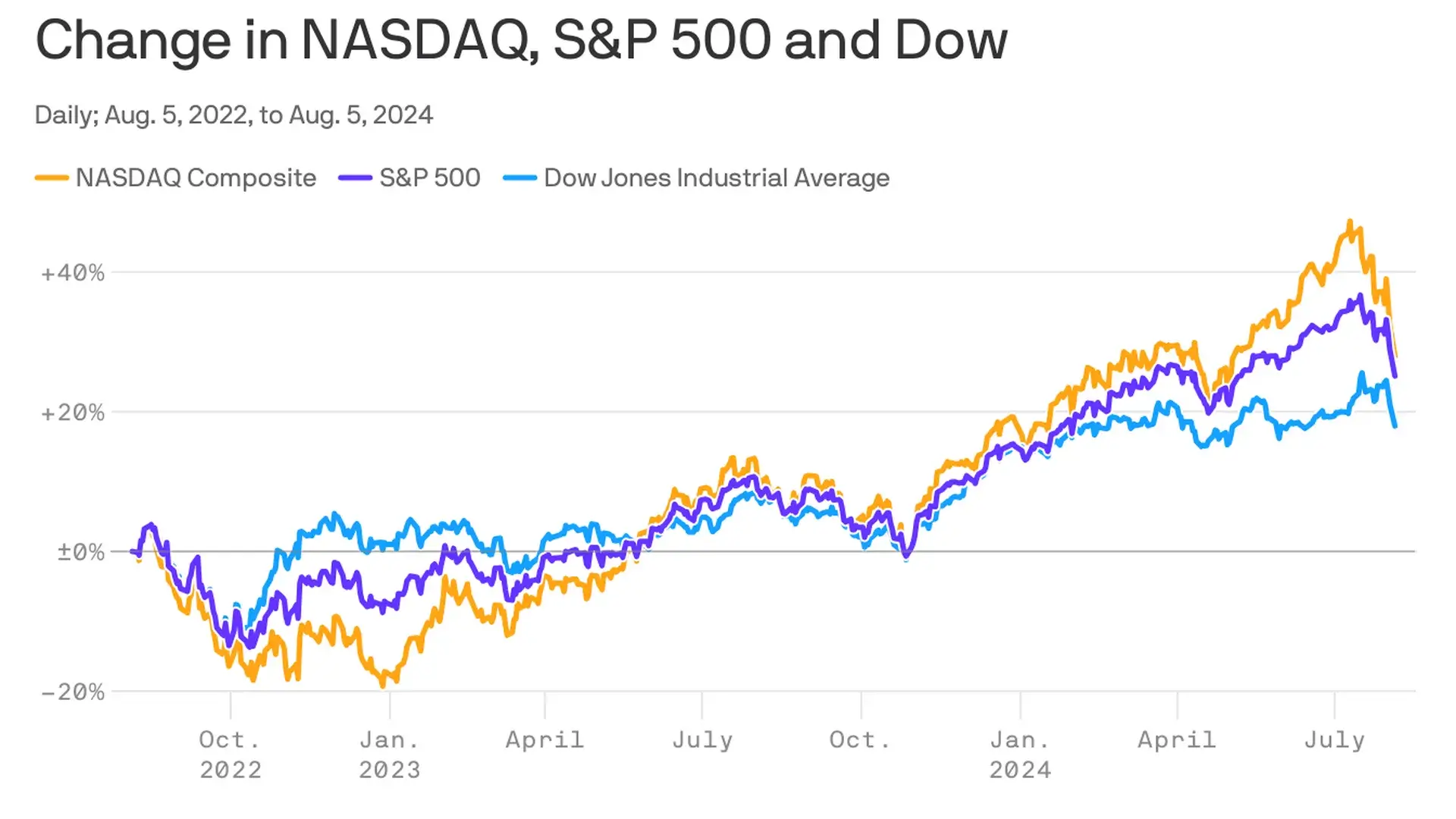

Recent Trends in the Dow Industrials

Throughout 2024, the Dow Industrials have seen significant fluctuations. Investors remain concerned about inflation, interest rates, and geopolitical tensions. These factors have caused stocks to swing between gains and losses.

In September 2024, the Dow fell below 33,000 points, driven by fears of a looming recession. However, strong earnings reports from major companies provided a brief boost. Despite this, concerns about the Federal Reserve’s ongoing interest rate hikes have weighed heavily on the market.

Impact of the U.S. Economy on the Dow Industrials

The U.S. economy is navigating a challenging period. Inflation remains elevated, though it has cooled slightly from its 2022 highs. The Federal Reserve’s aggressive rate hikes have curbed inflation but also slowed economic growth. This has left businesses and consumers grappling with higher borrowing costs.

As of 2024, the U.S. economy is not in a recession, but growth has slowed considerably. GDP growth projections for the year hover around 1-2%. Many industries are facing cost pressures, which have impacted corporate profits. This uncertainty has contributed to the Dow’s recent volatility.

Key Sectors Affecting the Dow Industrials

Several key sectors play a significant role in the performance of the Dow Industrials. Tech companies, which were once the market’s driving force, are now grappling with the effects of higher interest rates. Higher rates make future profits less attractive, leading to a decline in tech stock values.

Meanwhile, the energy sector has performed well in 2024. Rising oil prices have boosted the profits of companies like Chevron, one of the Dow’s components. The healthcare sector, traditionally viewed as a defensive investment, has also remained relatively stable, helping to balance out losses in more volatile industries.

The Role of Interest Rates

Interest rates remain a central concern for both the Dow Industrials and the broader economy. The Federal Reserve has raised rates multiple times in 2023 and 2024 to combat inflation. While inflation has eased somewhat, the impact of these rate hikes has been profound. Higher borrowing costs have led to decreased consumer spending, which in turn has hurt corporate earnings.

Additionally, higher interest rates tend to reduce the appeal of riskier assets like stocks. As a result, investors have been flocking to safer investments like bonds, leading to outflows from equities. This has contributed to the recent weakness in the Dow.

Geopolitical Concerns and Their Impact on Stocks

Geopolitical events also play a crucial role in shaping market conditions. The ongoing conflict between Russia and Ukraine continues to affect global markets. The resulting disruptions in energy supplies have caused oil prices to rise. While this has benefited energy companies, it has hurt industries reliant on cheaper fuel and transportation costs.

In addition, tensions between the U.S. and China over trade and technology have raised concerns about global supply chains. Any disruptions to these chains could have far-reaching effects on corporate profits, particularly in industries like tech and manufacturing.

Economic Outlook for the Rest of 2024

Looking ahead, the U.S. economy faces several headwinds. Consumer spending, a key driver of economic growth, has slowed as higher interest rates take their toll. Many consumers are prioritizing saving over spending, especially on big-ticket items like cars and homes.

At the same time, businesses are feeling the pinch of higher borrowing costs. This has led to a reduction in capital spending, which could slow future growth. The labor market, while still strong, is beginning to show signs of cooling, with job growth slowing in recent months.

Despite these challenges, there are some bright spots. Inflation, while still high, has shown signs of easing, and the Federal Reserve may pause its rate hikes later in 2024. Additionally, strong corporate earnings from select sectors could help stabilize the Dow in the coming months.

Navigating Volatility in the Dow Industrials

The Dow Industrials are currently facing a turbulent period, driven by a mix of economic and geopolitical factors. While the U.S. economy remains resilient, growth has slowed, and uncertainty looms large. Investors should brace for continued volatility as the Federal Reserve’s interest rate policies and global events continue to shape market conditions.

To navigate these uncertain times, it’s crucial to stay informed about economic developments and market trends.